Our Future and the Mistake We Continue to Make

the mistake we continue to make is about how we learn and make Decisions

Taking action on our future is less about ‘what‘ we know and ‘who‘ is in the room, than it is about ‘how‘ we come together to learn. We’ve had this wrong for a long long time.

Look at the photo below. This is a “climate action” conference. Observe how people in the room are positioned. Notice how one person is actively presenting to a large audience of folks, who are passively listening. The geometry of how they are all lined in rows and focusing on one person is actually how you place people if brain-washing is your goal. I know that seems a bit strong, but it’s actually true when you think about it: One person’s idea being obsorbed by many, with very little or no ability to interact with what they are hearing.

My point is this: The process and configuration that we presently use to learn in groups is the MISTAKE that will continue to drive inappropriate choices and unhealthy decisions about our future.

Instead, conferences, meetings, and gatherings, need to advantage of the collective mind that’s in the room by developing a vibrant, dynamic, life-generating, learning-exchange marketplace. In this learning exchange marketplace, a collaborative design process is used to shape an environment from which relationship-building and information-exchange is enhanced to a very high level. In this marketplace, information is traded and moved toward meaning, using a parallel collaboration process that allows for better choices to be created and thereby better decisions to be made. This process is called a CoLab.

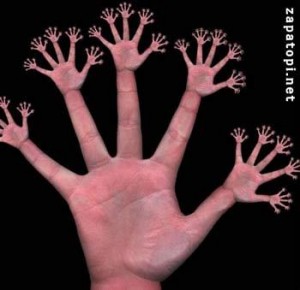

Note the chaotic nature of healthy interaction in this picture

A Colab taps into both a community’s collective emotional state, as well as its co-intelligent capacity, to bring out a diverse head/heart knowledge from people that rarely gets accessed in traditional group sessions. A Colab moves individual agendas into group-mind learning and reasoning by combining story-telling and metaphor-making as a key part of the collaboration process, thereby allowing for the intuitive brain to incorporate what the rational brain can not.

Furthermore, a Colab will transform a stuffy-room full of authoritative egos into a dance-hall of fun-loving folks who are sharing a diversity of ideas, morphing them into a consensus of choices, and turning them into an intelligent, strategic plan that can be rationally assessed and moved toward solution-based action. All this is done in a fraction of the time of traditional approaches (as seen in the picture), with an increased density of content being shared, received, and absorbed more easily by the majority (rather than the minority) of folks in the room. The result of a Colab process is that – rather than folks feeling frustrated, adversarial, and dreading the work ahead, I have found that more people leave feeling charged, accomplished, participants that are ready to act. Now THIS is how to move ourselves into a future that works!

For more on Collaborative Design, see how to create your own Colab.

+++

This is the article that triggered me to write this post …

—— Begin Forwarded Message

Investors Representing $13 Trillion Call for Climate Action Now

NEW YORK, New York, January 14, 2010 (ENS) – The world’s largest investors today issued a statement calling on the United States and other governments to “act now to catalyze development of a low-carbon economy and to attract the vast amount of private capital necessary for such a transformation.”

The U.S., European and Australian investor groups, who together represent $13 trillion in assets, called for “a price on carbon emissions” and “well-designed carbon markets” to provide “a cost-effective way of achieving emissions reductions.”

Investors urge governments to address the risks of climate change. (Photo courtesy Ceres )

The statement was announced at the Investor Summit on Climate Risk, a meeting of 450 global investors at the United Nations that includes U.S. Special Envoy for Climate Change Todd Stern, billionaire investor George Soros and former Vice President Al Gore.

The investors said while some progress towards a global agreement limiting greenhouse gas emissions was made at the UN climate summit in Copenhagen in December 2009, “we cannot wait for a global treaty.”

“Policymakers made only incremental progress in Copenhagen, leaving a great deal of work to be done to address the risks that climate change presents to the global economy and to investments,” they said. Anne Stausboll (Photo courtesy CalPERS )

“U.S. leadership is critical in this regard, including U.S. Senate action to limit and put a price on carbon emissions,” Stausboll said.

“What investors need most from national and state legislatures are transparency, longevity and certainty,” said Kevin Parker, global head of Deutsche Asset Management and member of Deutsche Bank’s Group Executive Committee.

“Until the U.S. Congress passes climate regulation, America will be at a competitive disadvantage in the development of renewable energy and other climate change industries,” he said.

The Investor Statement on Catalyzing Investment in a Low-Carbon Economy was endorsed by four groups representing more than 190 investors – the Investor Network on Climate Risk, Institutional Investors Group on Climate Change, IIGCC, the Investor Group on Climate Change, and the United Nations Environment Programme Finance Initiative.

“Given that Copenhagen was a missed opportunity to create one fully functional international carbon market, it is more important than ever that individual governments implement regional and domestic policy change to stimulate the creation of a low carbon economy,” said Peter Dunsombe, chairman of the IIGCC, a network of European investors.

“Time is of the essence and world leaders from both developed and developing countries need to act now to compensate for the lack of progress at an international level,” he said.

In their statement, the investors observed that the costs of action to reduce greenhouse gas emissions are “both affordable and significantly lower than the costs of inaction,” but said developing a global low-carbon economy will require “substantially increased levels of investment from the private sector.”

The UNFCCC Secretariat estimates that more than $200 billion in total additional investment capital for mitigation is required each year by 2030 just to return greenhouse gases to their current levels by then.

The International Energy Agency estimates that additional investment of $10.5 trillion is needed globally in just the energy sector from 2010-2030 to stabilize atmospheric concentrations of greenhouse gases at around 450 parts per million, the investors noted.

Mindy Lubber (Photo courtesy Ceres )

“This equates to roughly 0.1% of the total value of world financial assets and approximately 0.23% of the total value of debt and equity securities, so this is certainly an achievable level of investment – and one that would yield returns in terms of energy savings, energy security, reduced capital expenditures for pollution control, and avoided climate damages,” they said. “But it is also well above current investment levels.”

“As powerful as these investors are, they can’t underwrite a clean energy transformation at the critical scale needed without clear rules only government can provide,” said Mindy Lubber, president of Ceres, a U.S. coalition of investors and environmental groups, and director of the Investor Network on Climate Risk.

“Government policy can make clean energy cost-competitive by leveling the playing field with fossil fuels,” Lubber said. “Only government policy provides the long-term certainty that can turbo-charge private investment in clean energy, address the climate change threat and protect our planet.”

Click here to download the Investor Statement on Catalyzing Investment in a Low-Carbon Economy.

Copyright Environment News Service (ENS) 2010. All rights reserved.

—— End of Forwarded Message